TML

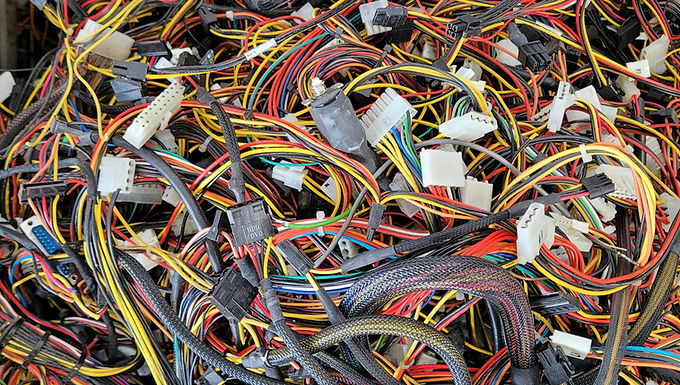

Untangling the Tax Issues

You think tax literacy is hard, well untangling some tax issues can be a nightmare. We will look at some of the more complex tax issues important to you and your business. Follow along!

A 2025 Guide for Parents and Student-Athletes Navigating Major NIL Deals

The landscape for college athletes has transformed dramatically since the NCAA and many states opened the door for student-athletes to profit from their name, image, and likeness (NIL). As seven-figure deals become more common at major universities, parents and student-athletes must be proactive in understanding the business and tax implications of NIL income. Recently, I had the opportunity to meet with parents and discuss some of the tax and business law implications of these new arrangements. Some families are well equipped with financial, tax and business advisors already in tow to meet the new challenges presented by NIL. However, there are tons of families out there that are simply blown away by the newfound financial successes their children find themselves. Of course, there are also a ton of folks out there willing to offer their services, too. This is big business. Most families will need to know how to navigate the waters to ensure the best way forward for their children with NIL deals. Knowledge is power. This TechTaxTalk series provides a guide - so to speak - for families and highlights some of the key issues and strategies to ensure compliance, minimize risk, and maximize the benefits of NIL opportunities.

1. Federal Tax Compliance: Income and Self-Employment Tax

All NIL compensation is taxable income. Whether a student-athlete receives cash, merchandise, or other benefits, the value must be reported on their federal tax return. Most NIL income is classified as self-employment or independent contractor income, not as wages. This means:

• Form 1099-NEC: Most organizations paying NIL compensation will issue a Form 1099-NEC, not a W-2. No federal income tax is withheld, so the athlete is responsible for paying taxes directly.

• Self-Employment Tax: In addition to regular income tax, student-athletes must pay self-employment tax, which covers Social Security and Medicare. For 2025, the self-employment tax rate is 15.3% (12.4% for Social Security and 2.9% for Medicare), with an additional 0.9% Medicare tax on income above $200,000 for single filers or $250,000 for joint filers.

• Estimated Tax Payments: Because taxes are not withheld, student-athletes must make quarterly estimated tax payments to avoid penalties and interest.

Key Strategy: Set aside a portion of every NIL payment for taxes. Work with a tax advisor to calculate and remit estimated payments on time.

2. State Tax Compliance: Residency, Sourcing, and Multi-State Issues

State tax rules vary widely. Student-athletes may owe taxes in multiple states, including their home state, the state where their university is located, and any state where they perform NIL activities (such as appearances or endorsements).

• Residency Rules: Generally, a student-athlete remains a resident of their home state unless they take steps to change domicile. Their home state will tax all income, while other states may tax only income earned within their borders.

• Sourcing Rules: States like California tax nonresidents on income earned for services performed in the state, even for a single appearance or event.

• Credits for Taxes Paid: If income is taxed in more than one state, credits may be available to avoid double taxation.

Key Strategy: Track where each NIL activity occurs and consult a state tax expert to ensure proper reporting and credit claims.

3. Managing Liability Exposure and Business Structure

NIL deals create business and legal risks. Student-athletes are often treated as independent contractors, not employees, which means they bear the risk of contract disputes, liability for services, and compliance with contract terms.

• Entity Formation: Forming a legal entity (such as an LLC or S corporation) can provide liability protection, potential tax benefits, and more flexibility in managing income and expenses. However, the benefits and costs should be weighed carefully, as the tax rate differences between individuals and corporations are narrower than in the past.

• Insurance and Contracts: Consider business liability insurance and have all contracts reviewed by a qualified attorney.

Key Strategy: Evaluate whether forming an entity is appropriate based on the size and complexity of NIL activities. Always use written contracts and seek legal review.

4. Tracking Income and Expenses

Accurate recordkeeping is essential. Student-athletes must track all NIL income and related business expenses to properly report taxable income and claim deductions.

• Deductible Expenses: Ordinary and necessary business expenses, such as travel, marketing, legal fees, and certain equipment, may be deductible.

• Segregation of Accounts: Use separate bank accounts for business and personal transactions to simplify accounting and support deductions in case of an audit.

Key Strategy: Use accounting software or hire a bookkeeper to maintain organized records. Save all receipts and documentation.

5. Making Estimated Tax Payments

Avoid underpayment penalties. Because taxes are not withheld from NIL payments, student-athletes must make quarterly estimated tax payments to the IRS and, if applicable, to state tax authorities.

• Deadlines: Estimated payments are generally due in April, June, September, and January.

• Calculation: Work with a tax advisor to estimate annual income and tax liability, adjusting payments as needed if income fluctuates.

Key Strategy: Set calendar reminders for payment deadlines and review income regularly to adjust estimates.

6. Impact on Financial Aid

NIL income can affect financial aid eligibility. All NIL earnings, including non-cash compensation, must be reported on the Free Application for Federal Student Aid (FAFSA). This can reduce need-based aid and may affect eligibility for certain grants and scholarships.

Key Strategy: Consult with the university’s financial aid office and a tax advisor to understand the impact of NIL income on aid packages and plan accordingly.

7. The Importance of Qualified Advisors

The NIL environment is complex and evolving. Laws and regulations are changing rapidly at both the federal and state levels. Student-athletes and their families should not attempt to navigate these issues alone.

• Tax Advisors: Ensure compliance with federal and state tax laws, maximize deductions, and avoid costly mistakes.

• Business Lawyers: Review contracts, advise on entity formation, and help manage legal risks.

• Financial Planners: Assist with budgeting, saving for taxes, and long-term financial planning.

Key Strategy: Build a team of qualified professionals with experience in sports, entertainment, and tax law to guide decision-making and protect the athlete’s interests.

Conclusion

NIL deals offer unprecedented opportunities for student-athletes, but they also bring significant business and tax responsibilities. By understanding the rules, planning ahead, and engaging experienced advisors, student-athletes and their parents can ensure compliance, minimize risk, and make the most of their NIL success. The key is to treat NIL activities as a business from day one—because, for tax and legal purposes, that’s exactly what they are.

This article is part of the "Untangling the Tax Issues" series for our TechTaxTalk blog. For more information or to connect with qualified advisors, contact your university’s compliance office or a trusted tax professional.