TML

Tax Literacy

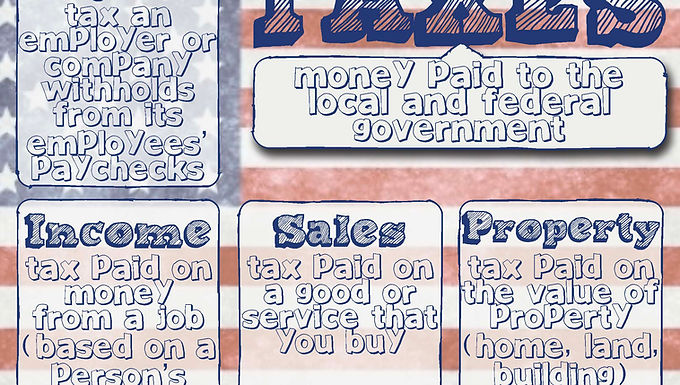

Taxes play a key, often overlooked, role in financial literacy. Knowing how much of your income is taxable, being aware of deductions and tax credits and knowing when taxes are due, is just the beginning. Follow along as we try to help broaden your tax knowledge.

Nexus: The Tax World’s “You Are Here” Sign

I had a funny exchange with a fairly sharp business friend a few weeks ago. His business is looking to grow and expand into other parts of the country. He commented that he "was being taxed all over the place." Said he "can't look in the direction of another state or jurisdiction without getting taxed by the Man." Of course, I said, 'or by the Lady." We both laughed then he asked, "why is that?" I simply replied 'it's "nexus" my friend, nexus.' He assured me that he'd never been "next" to any of those states. I laughed and thought of my next Tax Literacy topic! Thanks, pal!

So, in the world of taxes, “nexus” is a bit like the “You Are Here” dot on a mall map—except it tells a state or local government, “You (the taxpayer) are here, and we can tax you.” But unlike a mall map, the rules for when and where you show up can be surprisingly complex and sometimes even a little sneaky.

What Is Nexus? Nexus is a legal concept that determines when a business or individual has enough connection to a state (or local jurisdiction) for that state to impose its tax laws on them. Think of it as the threshold for when you cross from “just passing through” to “staying long enough to owe us taxes.”

Where Does Nexus Pop Up? Nexus isn’t just for one type of tax. Here’s where you might encounter it:

1. Income Taxes (Direct Taxes):

o If your business earns income in a state, owns property, has employees, or even just has significant sales there, you might have income tax nexus.

o Some states use “factor presence” rules: for example, if you have $500,000 in sales, $50,000 in payroll, or $50,000 in property in the state, you’re in nexus territory.

o For individuals, working in a state, owning property, or having other economic ties can create nexus for personal income tax.

2. Sales and Use Taxes (Indirect Taxes):

o Historically, you needed a physical presence (like an office or employee) to have sales tax nexus. But after the 2018 Supreme Court’s South Dakota v. Wayfair decision, just having enough sales or transactions in a state can create “economic nexus”.

o Most states now have thresholds (e.g., $100,000 in sales or 200 transactions) that trigger sales tax collection duties, even if you never set foot in the state.

3. Employment/Residence Taxes:

o If you or your employees work in a state—even remotely—nexus can arise for payroll and withholding taxes.

o Some states have “de minimis” rules (e.g., no tax if you’re there less than 10 or 20 days), but others don’t.

Fun (and Not-So-Fun) Nexus Triggers:

• Physical Presence: An office, warehouse, employee, or even inventory in a state.

• Economic Presence: Enough sales or transactions, even with no physical presence.

• Affiliate/Agency Nexus: A related company or third party acting on your behalf in the state.

• Click-Through Nexus: Paying commissions to in-state residents for online referrals.

• Factor Presence: Hitting certain thresholds for sales, property, or payroll.

Why Should You Care? For HNW individuals and small/midsize businesses, nexus can mean:

• Filing tax returns in multiple states (even if you never visit).

• Collecting and remitting sales tax in states where you have customers.

• Facing penalties for not registering or filing where you have nexus.

• Navigating special rules for financial institutions, digital businesses, or remote work.

Tips for Handling Nexus Like a Pro:

1. Know Your Footprint: Track where you have employees, property, sales, and business activities. Even a single remote worker or a few big sales can create nexus.

2. Understand State Thresholds: Each state sets its own rules. Some have bright-line thresholds; others are more subjective. Check the latest standards for each state where you do business.

3. Watch for “Safe Harbors”: Some states offer exceptions for minimal activity (e.g., trade shows, limited days, or small dollar amounts). Take advantage of these where possible.

4. Don’t Ignore Non-Income Taxes: Sales tax, franchise tax, and even gross receipts taxes can have different nexus rules.

5. Plan for Remote Work: The rise of remote employees can create unexpected nexus. Review your policies and track where your people are working.

6. Stay Current: Nexus rules change frequently, especially after major court decisions or new state laws. Review your nexus footprint at least annually.

7. Get Help When Needed: Nexus is complicated. Consult with a tax professional if you’re expanding, hiring remotely, or selling in new states.

Bottom Line: Nexus is the tax world’s way of saying, “If you’re here, you might owe us.” It’s not just about where you are, but where your business, your people, and your customers are. Stay aware, stay organized, and don’t be afraid to ask for help—because in the world of state and local taxes, knowing where you “are” can save you a lot of headaches (and dollars) down the road.